Startup Funding Rounds: Seed Series A, B, C

Attracting shareholders' finances is frequently quite complicated, takes a lot of time and effort, and leads to burnout or demoralizing. In order not to lose fight spirit and motivation, it is important to remember your desired end result – your capital that will assist you in developing your business and realizing your idea.

As practice shows, it takes around 3-4 months in average to raise money, although less or more time is possible too. A lot depends on the case, as well as on the experience in raising money and on the investors' willingness to invest.

While working on financing startups, the founder faces a number of problems — burnout, severe stress due to lack of money, fear of "burning out". In addition, you need to perform duties in two important areas — managing the company and raising investments.

The next complication is the increase in a number of people the founder has to interact with when passing through the rounds of startup funding. New investors may not be interested only in making a profit, but also in the possibility of real influence on the work of the company, which creates risks for the founder - they can simply be ousted from a leadership position.

However, despite lots of obstacles in the way of a startup founder, a perspective financial reward in case of success exceeds greatly constantly emerging problems. To be ready for injecting investments, please read a brief description of the funding rounds for startups below.

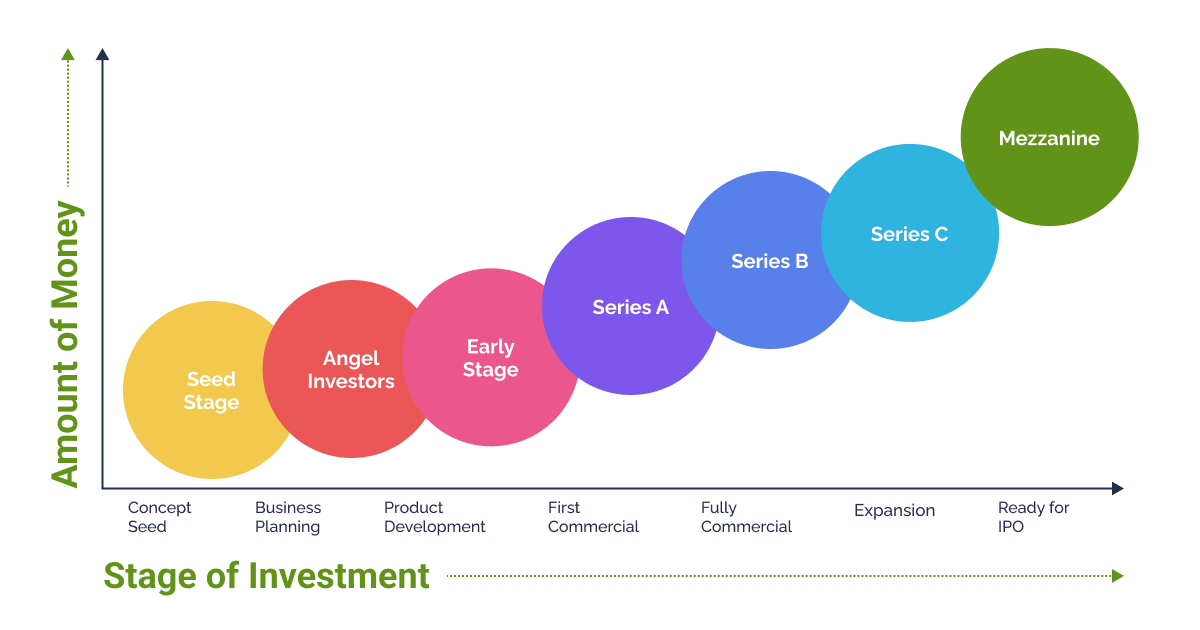

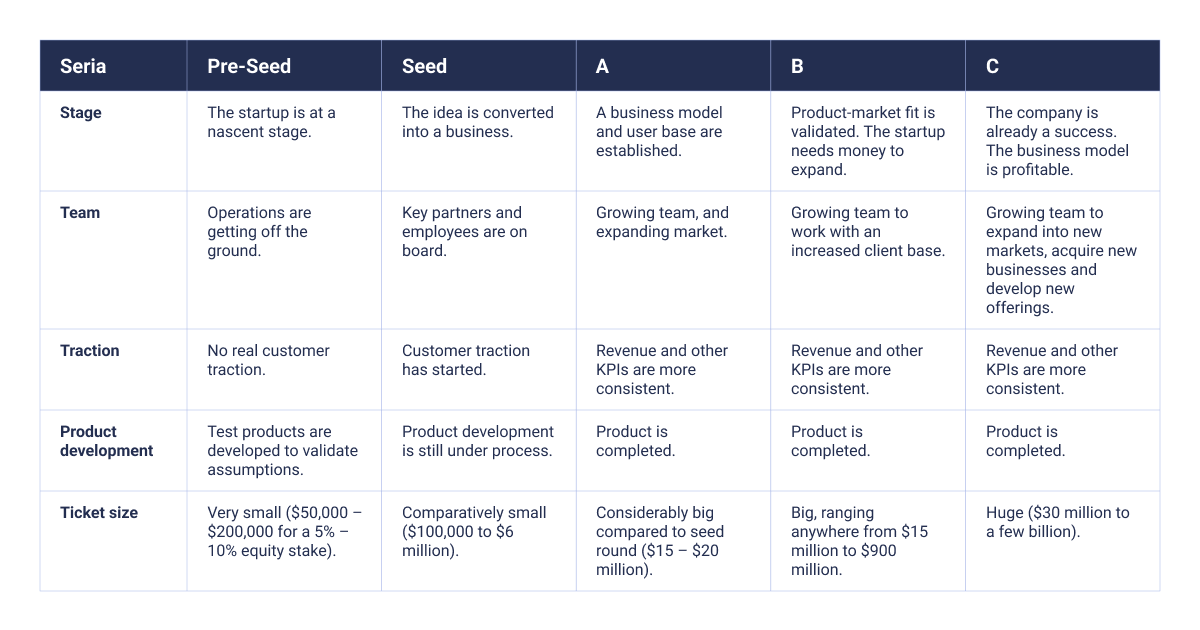

Pre-funding (Pre-Seed)

Pre-funding is, in fact, the initial stage of investing in a project. It is for this reason that the stage is often not included in the equity financing cycle.

The pre-stage involves a minimal number of people working on a prototype, or proof of concept. Funding comes from the founders' inner circle, the angel investor. It is difficult to talk about the volume of finance attracted in this period.

Initial funding (Seed)

The collection of the first money is traditionally called initial funding or seed funding. What is seed funding? These are those small finances with the help of which it will be possible to get the "sprouts" of the project and ensure its viability and profitability. Initial funding is applied when a startup moves from an idea to the first practical steps.

Unfortunately, for some projects, this point becomes final. The founders are forced to talk about failure if a startup doesn't gain momentum before the first round of fundraising runs out. A certain percentage of companies at the initial stage decide to stop collecting investments if enough funds are collected or the project can develop further on its own.

How much money is engaged in seed funding? As a rule, it is from $500,000 to $2,000,000, but the figures might vary up or down. The average value of the company which managed to raise money at the seed stage is from $3,000,000 to $6,000,000.

Series A funding

As soon as the initial funding stage is over and the company gains traction (there is a certain number of users, some income, number of views, and other parameters of KPI, defined by the company itself), series A funding takes off. If a success, this will lead the project to the next stage.

At this stage, the startup team presents their business model to investors and uses the funds raised to increase profits. Series A funding is expected to exceed the amount of money raised at the initial stage, reaching $2,000,000-$15,000,000. You are supposed to be ready to face the investors' demand to increase their profits.

The key element is attracting the very first investor who acts as a guarantee for other shareholders. Therefore, its loss is often devastating for the startup. Series А is funded by venture capitalists, angels, and crowdfunding. Statistics show that less than half of companies collect Series A investments after passing the seed stage.

Series B funding

The product matching indicates the possibility of a startup transitioning to the Series B round to the market and the need to expand the market. The main question that the founder faces now is how to make the company perform after scaling. At the same time, not only does the number of clients increase, but also the startup team does to serve a bigger audience.

The amount of series B funding makes $7,000,000-$10,000,000, with the company valued $30,000,000-$60,000,000. Venture capitalists or investors of the previous round invest their money at this stage. As the startup is being re-evaluated now, the previous investors are reinvesting to validate the guarantees.

Series C funding

The company enters series C funding when it feels ready to expand into new markets, acquire new enterprises, create and introduce new products. This is accompanied by the increase of the estimated value of the company.

Investments of the investment bankers and shareholders of private sector are evidence of the startup's reliability. But only those startups which created the product and won the loyalty and trust of the audience manage to obtain investments at this stage. The investors listed above seek to minimize risks and invest in leading companies to ensure income and return on investment. In fact, series C is the last round, although series D and E are also considered to be the next stages of funding by some experts. Approximately $26,000,000 are involved, with the value of the company from $100,000,000 to $120,000,000.

Read also: MVP vs Beta-version: What is the Difference?

Software Development Hub has considerable consulting and startup development experience, including IT startups related to innovative technologies, at the early stages of their formation (pre-seed, seed, and series A).

Categories

Share

Need a project estimate?

Drop us a line, and we provide you with a qualified consultation.